special tax notice empower

SPECIAL TAX NOTICE YOUR ROLLOVER OPTIONS. Or if your payment is from a designated Roth account to a Roth IRA or designated Roth account in an employer plan.

Sustainability Free Full Text Tourism Empowerment And Sustainable Development A New Framework For Analysis Html

As an employee of JPMorgan Chase you have the opportunity to participate in the JPMorgan Chase 401k Savings Plan one of the best ways for you to prepare for your retirement.

. The Special Tax Notice also called a Rollover Notice or 402f Notice must be furnished to plan participants any time all or a part of a distribution is eligible for rollover. That means the Notice doesnt have to be provided until the participant elects a distribution. This notice is intended to help you decide whether to do such a rollover.

This notice is intended to help you decide. Convey information needed before deciding how to receive plan benefits. Special Tax Notice Regarding Retirement Plan Payments Your Rollover Options You are receiving this notice because all or a portion of a payment you are receiving from the_____INSERT NAME OF PLAN the Plan is eligible to be rolled over to an IRA or an employer plan.

Empower Retirement is required to withhold state income taxes based on state law unless you elect out of withholding. Special tax notice regarding plan payments. If youre among the millions of Americans who are changing jobs these days part of the Great Resignation as its come to be known youll likely find yourself evaluating 401k offerings.

Special Tax Notice Regarding Rollovers. You are receiving this notice because all or a portion of a payment you are receiving from your retirement plan is eligible to be rolled over to an IRA or an employer plan. Explain how to defer federal income tax on 403 b savings.

Participants complete the top portion of the form Participant Information along with the reason for payment indicated in the following section. This notice is provided to you because all or part of the payment. We will empower taxpayers by making it easier for them to understand and meet their filing reporting and payment obligations.

The Default Investment Notice outlines your rights if you have not chosen funds but are making contributions to the Plan. The role is also responsible for managing special projects and modelling the impact of operational changes and tax law. Special Tax Notice to Plan Participants Regarding Payments from Qualified Plans from the Plan Administrator or the participant website.

401k Savings Plan Enrollment Guide. This Special Tax Notice Applies to Distributions from Governmental 457b Plans This notice contains important information you will need before you decide how to receive Plan benefits. 402f SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS.

Office of Personnel Management Form Approved. This notice is provided to you by. Retirement Operations OMB No.

Usually it is included along with the distribution form. We continue to add and enhance tools and support to improve taxpayers and tax professionals interactions with the IRS on whichever channel they prefer. Replaced by Empowers Paycheck Contribution Election form.

The Manager Taxation - Tax Controversy Modelling and Special Projects manages tax controversy matters including federal and state tax examinations and notice responses and documenting of significant tax positions. The District of Columbia only requires mandatory withholding on a lump sum. Our goal is to.

A guide to evaluating an important part of your benefits package. SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS Alternative to IRS Safe Harbor Notice - For Participant This notice explains how you can continue to defer fede ral income tax on your retirement plan savings in the Plan and contains important information you will need be fore you decide how to receive your Plan benefits. Empower Representative Compensation.

The Special Tax Notice Regarding Plan Payments explains the tax consequences of taking a distribution from your Plan. DC-4253-1105 Page 1 of 4. Empower retirement special tax notice keyword after analyzing the system lists the list of keywords related and the list of websites with related content in addition you can see which keywords most interested customers on the this website.

I elect no state income tax withholding. AccuCustomizationmetaTagsdescription logon authenticationerrorMessage translateauthenticationerrorMessageParams logonlogonTitle translate. This disclosure describes compensation practices for Empower Retirement LLC Empower employees who interact with individual investors such as investors in retirement plans recordkept by Empower or investors in individual retirement or brokerage accounts offered through Empower or its affiliates.

FA 403B Special Tax Notice Form. Receiving this does not mean you are eligible for a distribution or that you have requested a distribution. SECTION 1 - 402f NOTICE.

Special Tax Notice Contact information. Replaced by Empowers Incoming Rollover Request form. 1 These documents include additional text from Notice 402f the Special Tax Notice Regarding Plan Payments.

While the Tax Code allows plans to create their. The statements contained in this notice prepared by the Office of Personnel Management OPM are based upon a review of Internal Revenue Service IRS publications specifically Publications 575 Pension and Annuity. You are receiving this notice because all or a portion of a payment you are receiving from the Plan is eligible to be rolled over to either an IRA or an employer plan.

Empower and Enable All Taxpayers to Meet Their Tax Obligations. This notice explains how you can continue to defer federal income tax on your retirement savings in your retirement plan the Plan and contains important information you will need before you decide how to receive your Plan benefits. After all a 401k retirement plan is a key part of your benefits package but the type of 401k plan each.

Special Tax Notice For Payments Not From a Designated Roth Account YOUR ROLLOVER OPTIONS. A9164_402f Notice 0321 3 W The exception for payments made at least annually in equal or nearly equal amounts over a specified period applies without regard to whether you have had a separation from service. It explains when and how you can continue to defer federal income tax on your retirement savings when you receive a distribution.

Request to Contribute Rollover Funds to the Choice 401k Plan.

Empower Taxpayers Internal Revenue Service

Empower Taxpayers Internal Revenue Service

Amazon Com Craft Tastic Empower Flower Diy Arts Crafts Kit Creative Fun Project To Encourage Self Expression Build Self Esteem Create Confidence In Kids Tween Teens Toys

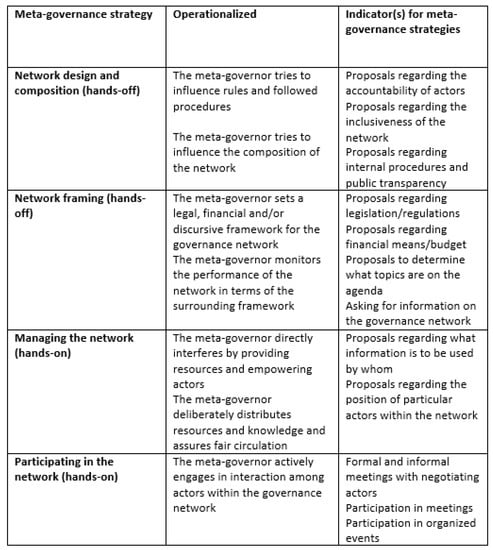

Sustainability Free Full Text Political Leadership As Meta Governance In Sustainability Transitions A Case Study Analysis Of Meta Governance In The Case Of The Dutch National Agreement On Climate Html

Empower Taxpayers Internal Revenue Service

Yes You Re In The Right Place Welcome To Empower Retirement As You Navigate Your Site You Ll Notice Many Of The Pages Still Have A Massmutual Logo That S Okay It Will Take Some Time To Fully Transition You To The Empower Experience We Look Forward To

Downloads Flexible Offsite Construction Software Hsbcad

Yes You Re In The Right Place Welcome To Empower Retirement As You Navigate Your Site You Ll Notice Many Of The Pages Still Have A Massmutual Logo That S Okay It Will Take Some Time To Fully Transition You To The Empower Experience We Look Forward To

Kucoin Labs Launches 100 Million Metaverse Fund To Empower Early Stage Metaverse Projects Business Wire

Pdf Technology As The Key To Women S Empowerment A Scoping Review

Oracle Perspective Tech Trends 2020 Empowering The Digital Journey With Oracle Deloitte

Pdf Behavior Change Or Empowerment On The Ethics Of Health Promotion Goals

Empower Renames To Bolster Engagement With Customers Business Wire

Yes You Re In The Right Place Welcome To Empower Retirement As You Navigate Your Site You Ll Notice Many Of The Pages Still Have A Massmutual Logo That S Okay It Will Take Some Time To Fully Transition You To The Empower Experience We Look Forward To

Who Benefits From Illiteracy Literacy And Empowerment

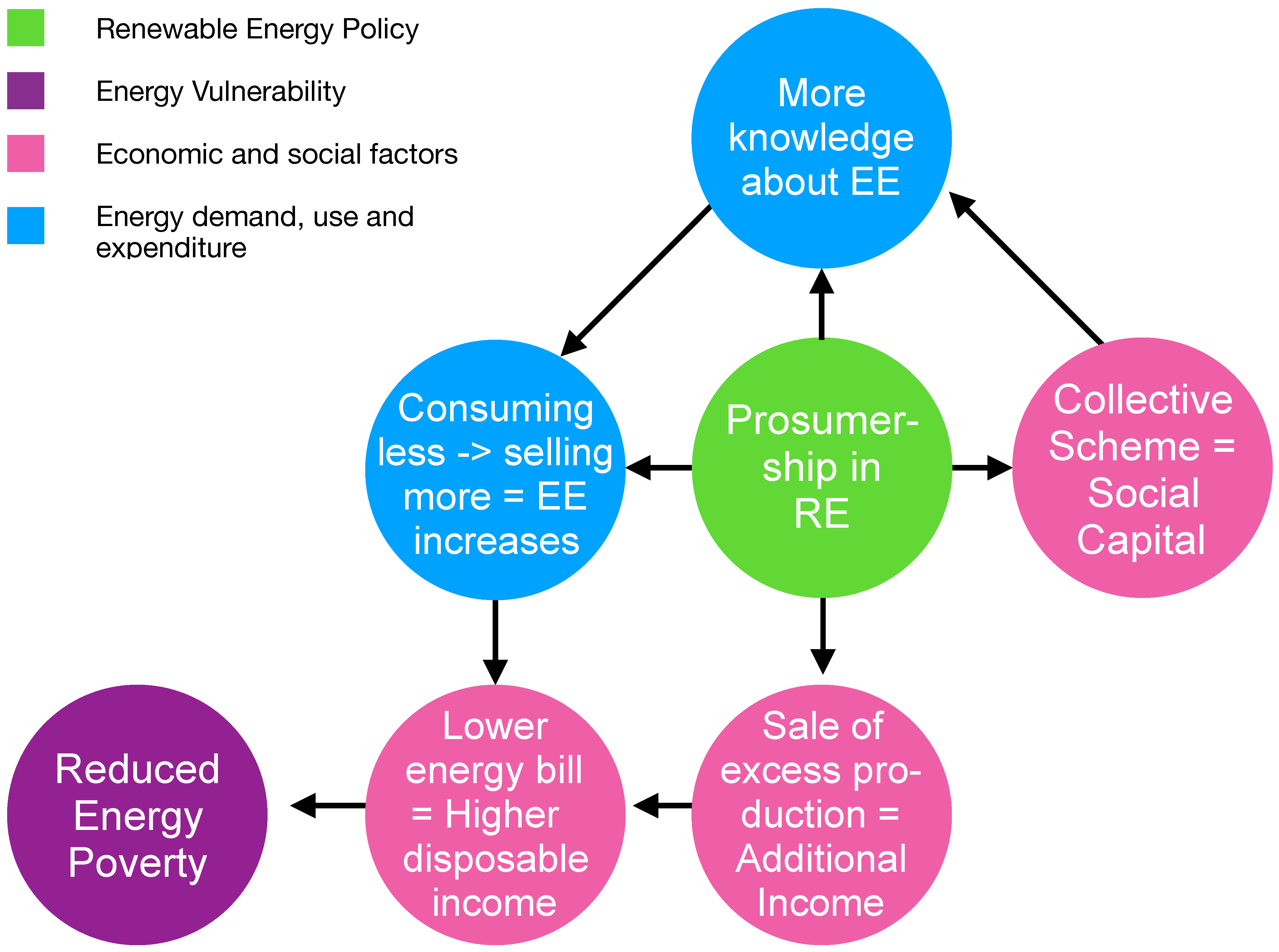

Energies Free Full Text Empowering Vulnerable Consumers To Join Renewable Energy Communities Towards An Inclusive Design Of The Clean Energy Package Html